[ COMPLIANCE_PLATFORM ]

E-Invoicing Compliance SaaS Platform

Simplifying Compliance. Scaling Businesses. Scale Compliant. Grow.

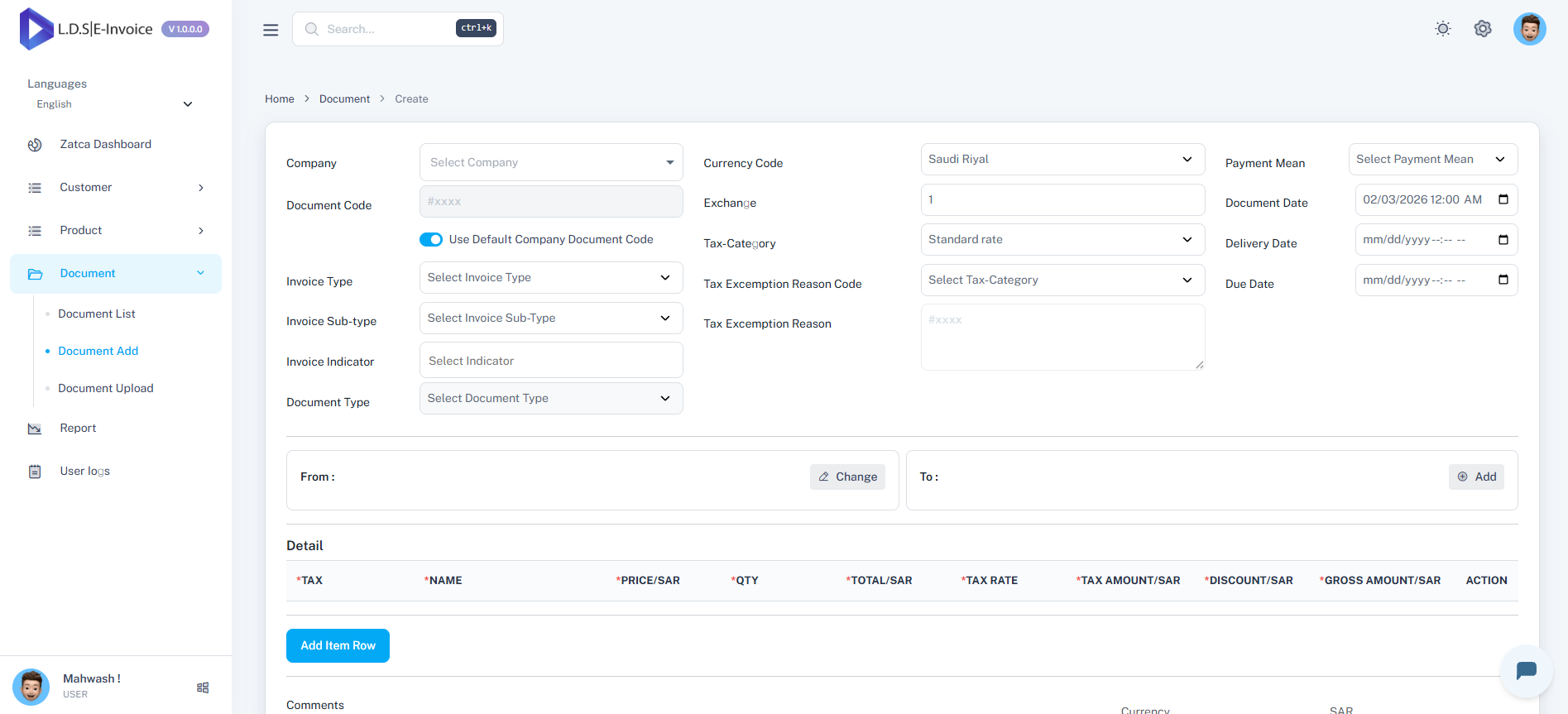

Product Demo

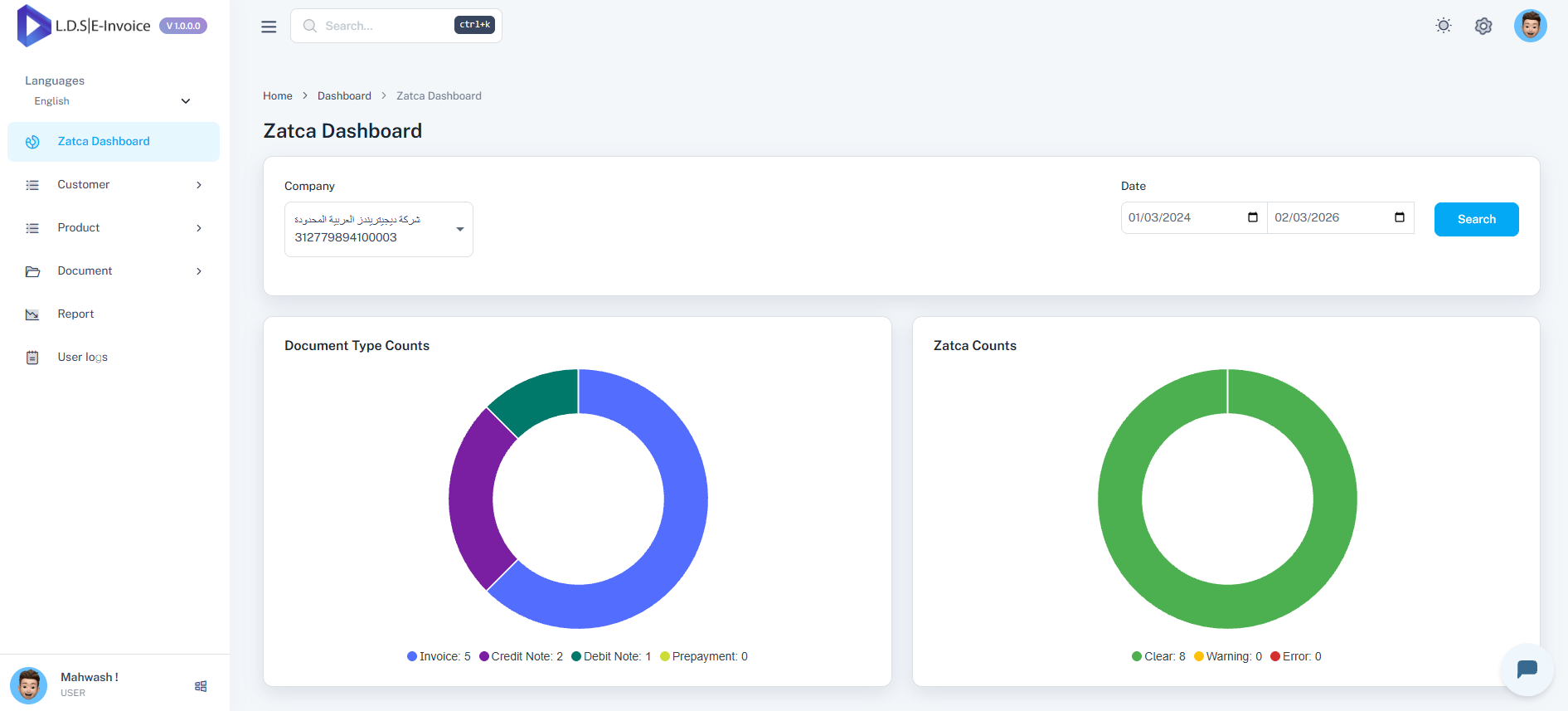

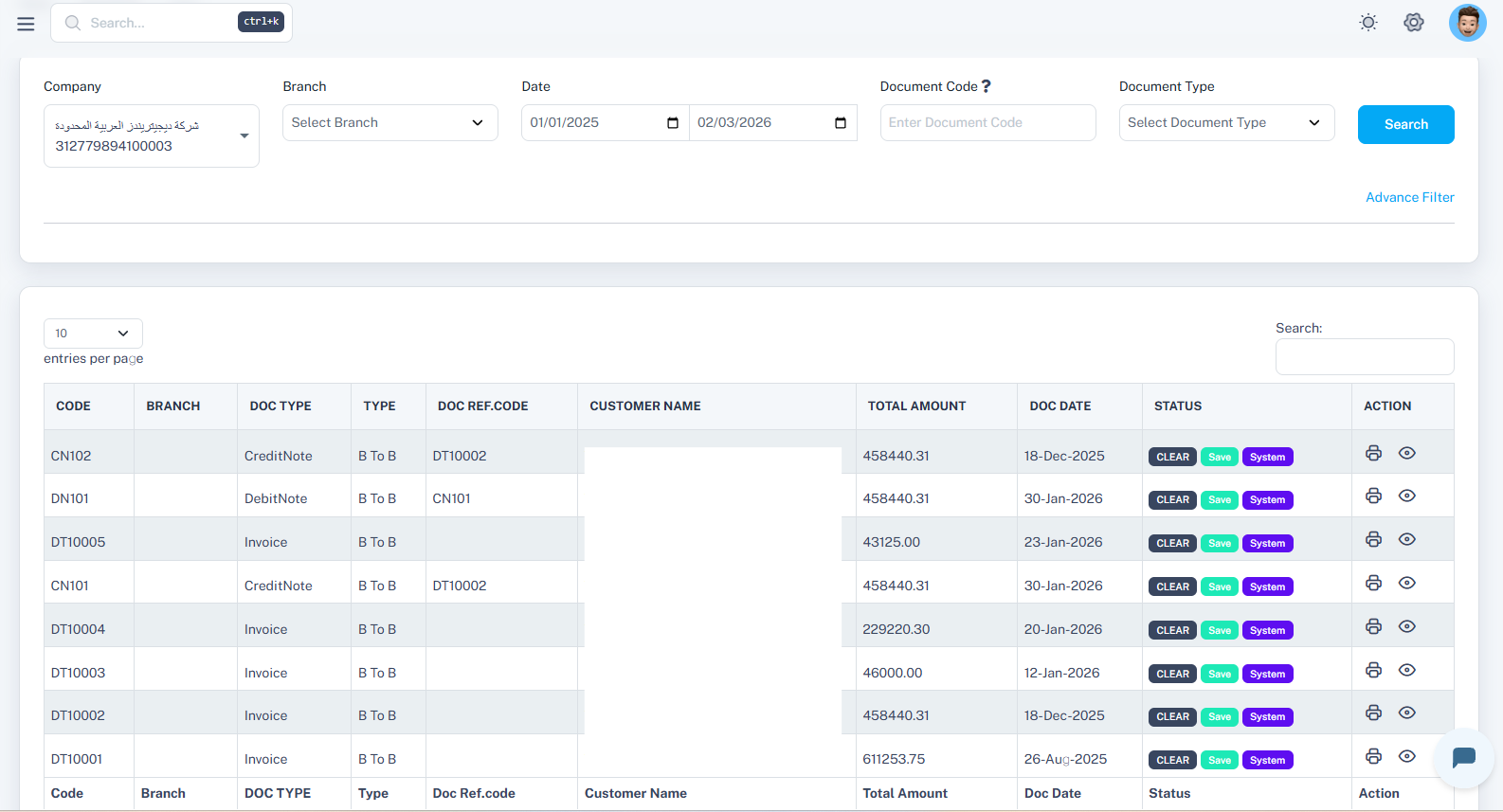

See our E-Invoicing Compliance Platform in action. Explore the interactive ZATCA dashboard below. For a complete walkthrough with full explanation and step-by-step guidance, use the video at the bottom of this section.

Explore Our E-Invoicing Software

Want the full demo with full explanation and walkthrough?

Click here to watch on YouTubeGlobal E-Invoicing Solution

Our e-Invoicing software is dynamic and can be integrated with the compliance requirements of any country's tax regulations.

Supported Jurisdictions

Malaysia E-Invoicing Solution

Malaysia's Inland Revenue Board (LHDNM) introduced the MyInvois System to digitalize tax administration and ensure compliance for all businesses operating in Malaysia. Similar to ZATCA in Saudi Arabia, this system mandates that invoices be issued, validated, and stored electronically, covering B2B, B2C, and B2G transactions.

Our e-Invoicing solution integrates seamlessly with the MyInvois System, enabling clients to stay compliant while maintaining operational efficiency.

Core Features

Digital Signatures & Security

Every invoice is digitally signed and transmitted over secure TLS channels, ensuring authenticity, integrity, and compliance.

Real-Time Validation

All e-Invoices are submitted to LHDNM for validation. Once validated, each invoice is assigned a Unique Identifier Number (UIN) for traceability.

ERP Integration

For companies using ERP systems such as Oracle, Odoo, SAP, our solution integrates directly with your ERP. Flow: ERP → Middleware → MyInvois API

Invoice Management

Suppliers and buyers can access the MyInvois portal to view, reject, or cancel invoices within the allowed timeframe.

QR Code Embedding

Validated invoices are shared with buyers and include a QR code for verification through the MyInvois portal.

Comprehensive Reporting

Suppliers and buyers access dashboards and summaries of validated invoices for compliance and audit readiness.

Benefits for Businesses

- Automated validation reduces manual processing and improves accuracy.

- Direct integration ensures minimal operational disruption.

- Supports multiple jurisdictions (KSA, UAE, Oman, Malaysia).

- Reduced errors and operational costs.

- Seamless ERP connectivity.

- Cybersecurity compliant architecture.

- Compliance without changing existing systems.

KSA E-Invoicing Solution

Saudi Arabia's Zakat, Tax and Customs Authority (ZATCA) introduced e-Invoicing in 2021 to digitalize tax administration and strengthen compliance. The mandate is rolled out in Phase 1 and Phase 2, requiring businesses to issue, validate, and store invoices electronically for B2B and B2C transactions with strict security and clearance requirements.

Our solution integrates seamlessly with ZATCA, ensuring full compliance with Phase 1 and Phase 2 while maintaining smooth ERP workflows.

The Problem

- Businesses struggle with ZATCA Phase 2 compliance.

- Manual invoice processing causes errors and penalties.

- Multi-ERP environments create integration chaos.

- Compliance breaches risk fines and reputational damage.

Our Solution

A ZATCA-certified SaaS platform that automates invoicing compliance.

- Works with Oracle, SAP, Microsoft Dynamics, custom ERPs.

- Real-time clearance and reporting to ZATCA.

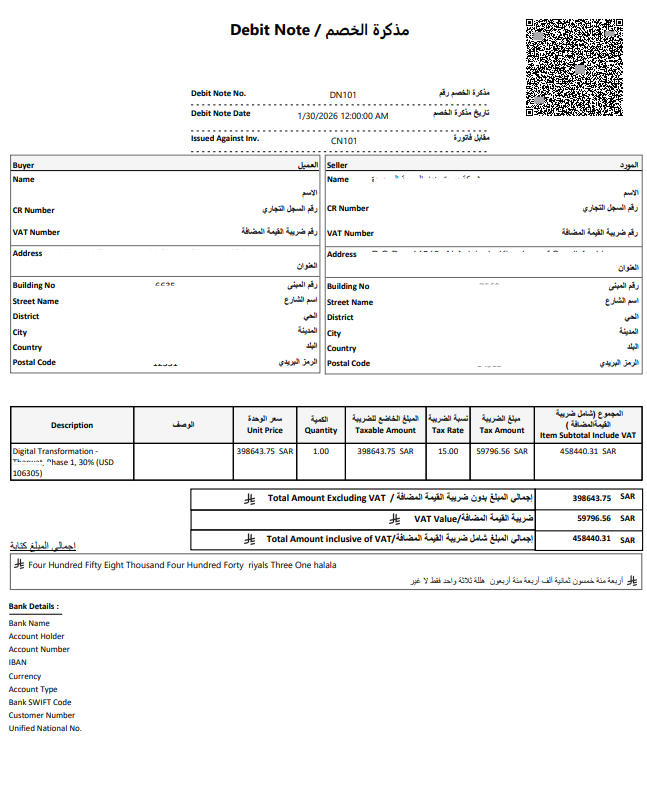

- End-to-end automation from creation to archiving.

- Cloud-based, scalable, secure infrastructure.

ZATCA Compliant

Fully certified for Phase 1 and Phase 2 with QR codes, cryptographic stamps, and real-time clearance.

End-to-End Automation

Invoice creation → validation → clearance → archiving → ERP sync with zero manual intervention.

ERP Integration

Seamless API-based connection with Oracle, SAP, Microsoft Dynamics, and custom ERPs.

Key Product Features

Why We're Different

- Multi-lingual support (Arabic / English, extendable)

- End-to-end automation from draft to ERP sync

- Processing 50,000+ invoices daily

- Proven at scale for 100+ businesses

- SAMA and cybersecurity compliant

- Region-specific compliance focus for KSA, Oman, UAE, Malaysia

Market Opportunity

- Global e-Invoicing market projected to exceed $35B by 2030.

- GCC countries moving toward compliance.

- Every VAT-registered business in KSA is mandated for ZATCA Phase 2.

- Custom ERP solutions preferred over large generic ERPs.

Traction & Clients

Technology & Security

Enterprise-grade stack with end-to-end encryption, role-based access, and audit-proven security.

Business Model

- SaaS subscription (monthly / annual)

- Transaction-based pricing for high volume

- Implementation and integration services

- Training services

- Cross-sell: ERP, AML, Fasah Pay, POS

"We're not just a software platform. We're enabling financial compliance and business growth across the Middle East and beyond."

Thank You.